A Net Promoter Score (NPS) helps companies measure customer satisfaction. The proponents of NPS argue that NPS is directly related to revenue growth and profitability. Considering that keeping existing customers is 25 times cheaper than getting new ones, maintaining an above industry average NPS is indispensable to sustained growth.

PayJoy Mexico — where unlike our other markets we originate on our own balance sheet — carried out an SMS campaign last week among 5,000 randomly selected customers who used us for smartphone financing in the past 12 months. We asked a simple question: “Based on your experience with us, from 0 to 10, how likely are you to recommend PayJoy?” We received 396 responses and calculated our score from there. You can see the details of our methodology and results below:

Methodology:

- From all customers that had purchased a smartphone using PayJoy, the company randomly selected 5,000 of them.

- The company asked: Based on your experience with us, from 0 to 10, how likely are you to recommend PayJoy?”

- Out of 5,000 randomly selected customers, 53 were no longer in service.

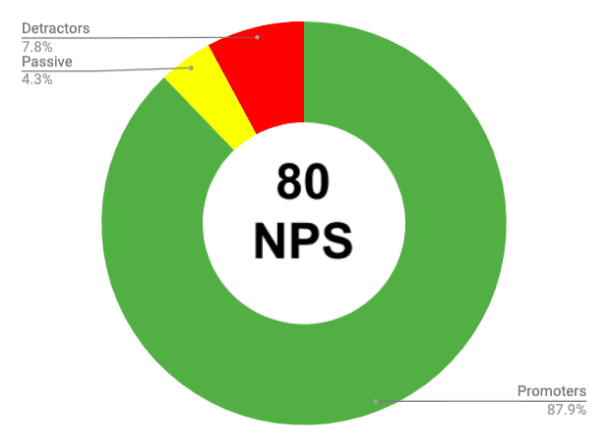

From those 4,947, we received 396 answers and 41 were not considered due to lack or invalid response, mostly, non-numeric responses. - 10 and 9 were considered promoters, 8 and 7 passive and 6 to 0 detractors.

- The calculation was: Promoters (as a % of total) – Demoters (as a % of total) x 100.

- If the response was not 0 to10 the answer was not considered (51)

- Conclusion: Based on our sample and the responses we received “we are 96% confident that our NPS of 80 represents the true population mean (for customers that obtained a smartphone finance by PayJoy).

The final NPS calculated — 80 –means customer satisfaction is considered, by many, world class. As a benchmark, in Mexico, financial services averages an NPS of 46, while Telecommunications averages 24 and banking averages 37 per CustomerGauge. 83% of people trust recommendations from people in their inner circle per Nielsen, so this also contributes significantly to PayJoy’s growth.

PayJoy’s mission is to provide access to consumer finance to the next billion people worldwide. Mexico, as its first international market and the only one where it originates on its balance sheet, is key to enable PayJoy’s mission since it spearheads initiatives to ensure the products can be launched elsewhere worldwide.

“We are very excited to know our customers are happy with our solution. That being said, we are continuing to work on many initiatives to improve our customer experience and give our customers more access to financial products” said Juan Jose Ocariz, PayJoy’s Mexico Country Manager.