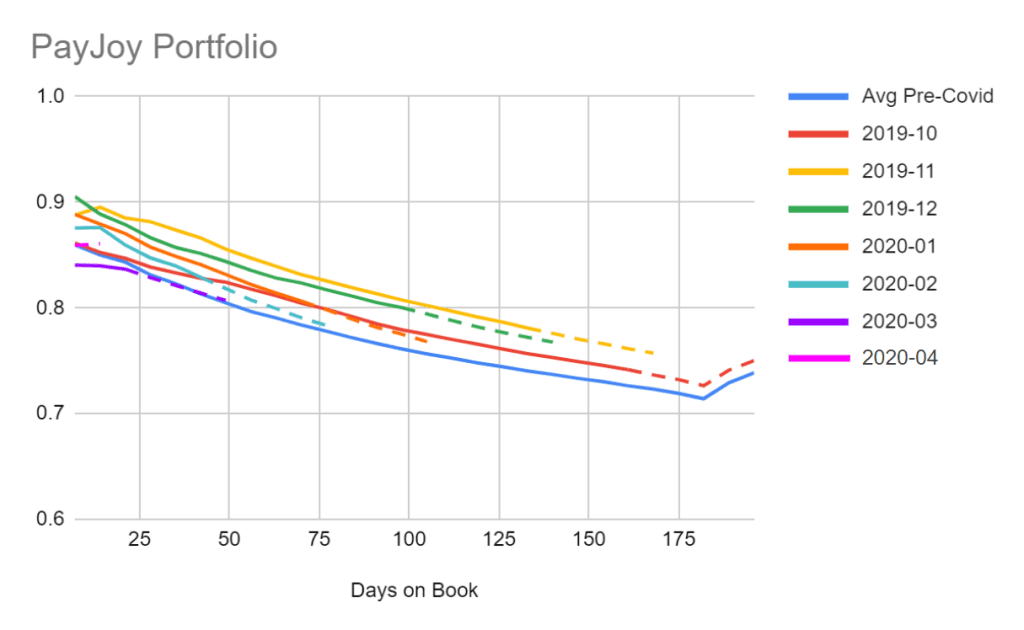

Innovative technologies like the PayJoy Lock are likely to lead to the next smartphone boom on the continent.

The last few years have been tough for smartphone shipments in Africa. However, according to the most recent figures announced by International Data Corporation (IDC) in 2018, Africa experienced year-on-year growth in smartphone shipments for the first time since 2015. The global technology research and consulting firm’s Quarterly Mobile Phone Tracker report shows the African smartphone market grew a modest 2.3% in 2018 to a total 88.2 million units, spurred by the strong performance of the continent’s three biggest markets – Nigeria, South Africa and Egypt.

Looking ahead, IDC expects Africa’s overall smartphone market to grow 5.4% year on year in 2019, to a total 92.9 million units, stimulated by the introduction of more affordable devices in the African market, which will help drive progress in this space over the coming years.

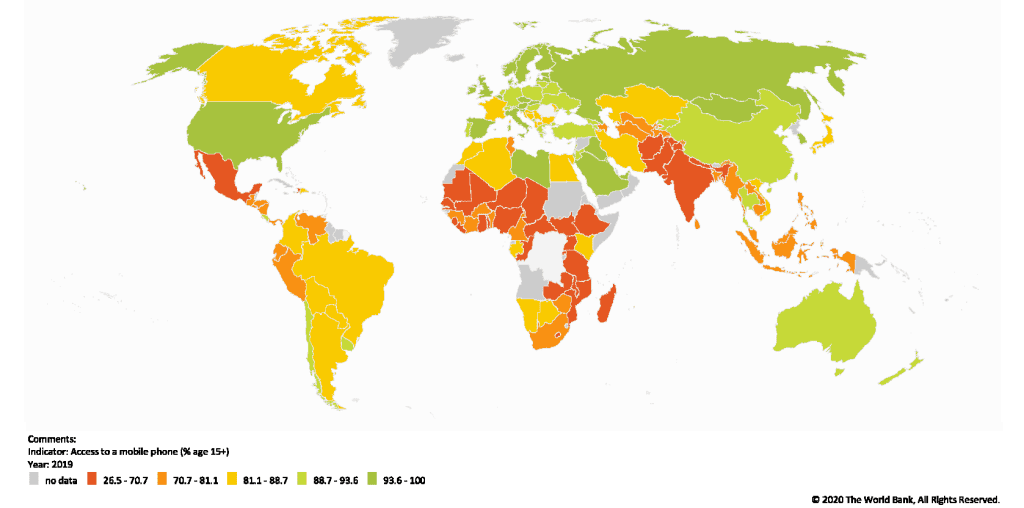

We often hear about high-growth markets like India, Indonesia and Vietnam, which are forecast to show growth in smartphone shipments in 2019. Growth in Africa should theoretically be significantly higher due to the relatively low base for smartphone and mobile internet penetration, which, as of the end of 2018, was just 33% and 38% respectively.

Sign up for The Newsletter

Upgrade to Medium membership to directly support independent writers and get unlimited access to everything on Medium.

What are the main factors constraining the acceleration of smartphone adoption in Africa?

In many countries, macroeconomic factors are to blame for some of the smartphone industry stagnation. Nigeria, for example, experienced an economic downturn and a shortage of foreign exchange, which impacted sales of imported products, including smartphones. South Africa also slipped into a technical recession in 2018, as the economy shrunk for two consecutive periods.

According to the GSM Association (GSMA), a trade body that represents the interests of mobile network operators worldwide, affordability still represents a significant barrier to the uptake of mobile services in the region, with the total cost of mobile ownership (TCMO) determined by the cost of service usage (voice, data, SMS), activation and mobile handset. Countries in Sub-Saharan Africa have among the highest level of TCMO as a proportion of income worldwide; this is particularly pronounced for those at the bottom of the income pyramid. For the 27 countries in the region where data is available, the TCMO for purchasing a handset and 500MB of data per month represents on average 10% of monthly income, well above the 5% threshold recommended by the UN Broadband Commission.

According to PayJoy’s own market analysis and affordability ratio, on average, the price of the cheapest smartphone represents 63% of monthly income. In 33 of 41 African countries, the price over income ratio is higher than 20%. In Nigeria, for example, the average selling price of an entry level smartphone is $65 while the GNI per capita is $173 per month, which represents an affordability ratio of 38%.

With some sense of normality returning to economics across Africa and affordability somewhat improving, what will help the smartphone industry prosper in the next few years?

For one, industry leaders are expected to increase their focus on putting affordable smartphones in more people’s hands as mobile subscriber penetration approaches saturation levels across Africa. This focus on smartphones, in turn, will help boost data revenues for network operators in a market where voice revenue growth has flatlined.

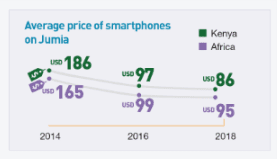

According to Jumia, Nigeria and Kenya’s leading ecommerce platform, the average selling price (ASP) of smartphones continues to fall year on year in most markets across Africa: smartphone average prices across Africa were $95 in 2018, down from $99 in 2016 and down from $165 in 2014.

Source: Kenya Mobile Report 2019

The smartphone industry in Africa has remained a truly competitive landscape over the years, with Chinese brands dominating the African markets with their strategy of introducing lower price points specifically for the profiles of African users. However, that said, it’s evident that the year on year reduction in average selling price (ASP) of smartphones is slowing significantly and with the enhancement of technologies like displays, cameras and 4G/5G technologies, one could expect the ASP’s to start increasing again, as they have globally.

Other factors that could help bring the cost of devices down for consumers:

- The availability of Android Go, a streamlined version of the Google mobile operating system.

- The rise of the “Smart Feature Phone” powered by KaiOS, a new class of mobile device.

Android Go was designed for low-power devices (Chipset & Memory), and the operating system will enable handset manufacturers to ship smartphones that while not as full-featured as a flagship device, still offer a reliable and responsive end-user experience well suited to the African markets. Android Go is Google’s new product for the next billion users.

There is certainly ample opportunity for the mobile industry and ecosystem players to improve smartphone affordability in emerging markets like Africa and to borrow from a prominent financial institutions tagline, the time is now right for some “Solutionist Thinking”!

Keep an eye out for our next blog post where we will look for “Lessons from other industries, leading to new innovative solutions for making smartphone for affordable and accessible”

For more information, visit www.payjoy.com. Join the smartphone financing conversation by visiting the PayJoy blog, Twitter, LinkedIn and Facebook pages.

SOURCE PayJoy

Written by: Dominique Friedl, GM PayJoy Africa

April 3, 2019